Data Chart on the Impact of Interest Rates | Mortgages | Industry Development | The Australian Central Bank’s Interest Rate Increase on Mortgages

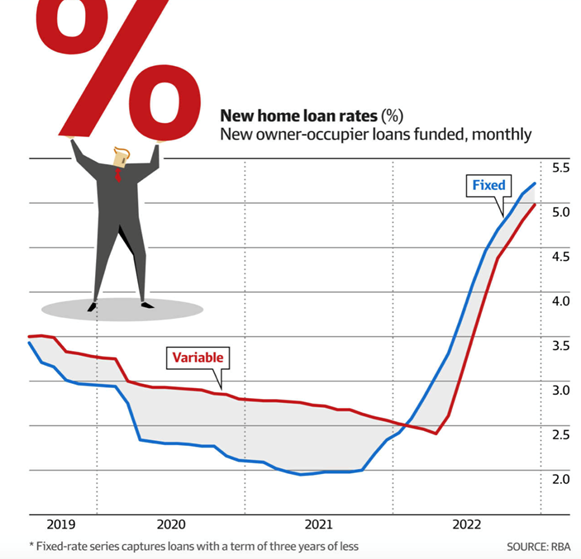

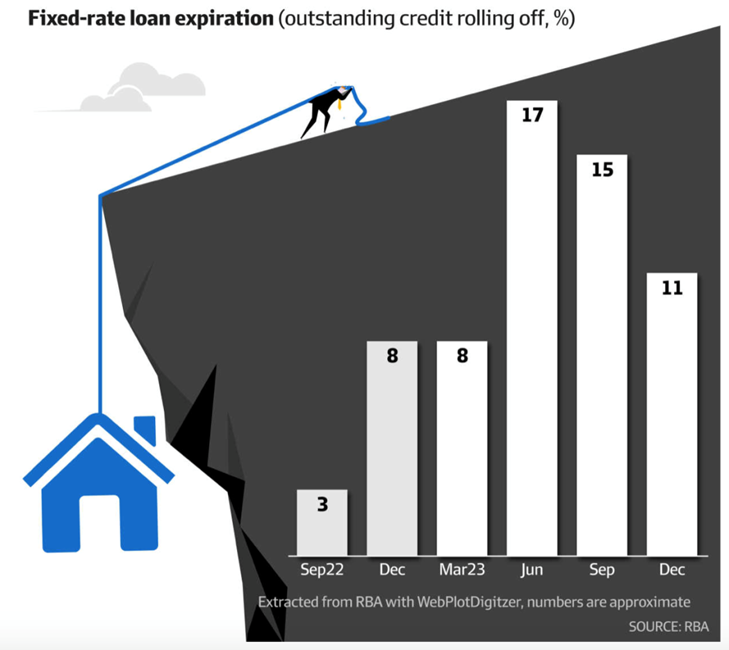

Due to consecutive interest rate hikes by the Reserve Bank of Australia, as many as 880,000 Australian households will need to pay hundreds or even thousands of extra dollars towards their mortgage every month; especially when their fixed rate terms expire this year, they will face even more pressure on their mortgage repayments.

According to data statistics, households repaying a mortgage loan of 550,000 AUD (the average size of loans issued from 2020 to 2022) will see an increase of 891 AUD in their monthly repayment amount. For heavily indebted households, the increase in repayment amount will be even higher. For instance, those with a 1 million AUD mortgage loan will have to pay an extra 1620 AUD per month.

Overall, the Reserve Bank of Australia estimates that 90% of fixed-rate loans this year or next year will have to bear an increase of at least 30% in mortgage repayment amounts. (The figure is sourced from relevant sources such as RBA and ABS Australia Financial and Economic News.)