Real estate | industry development | housing approval volume may continue to remain sluggish

The newly released data on new home approvals show a 4% increase in February compared to January, with a seasonally adjusted total of 12,661 units, which is lower than expected. The spokesperson indicated that the long-term slump in residential approvals may continue into 2023 and 2024.

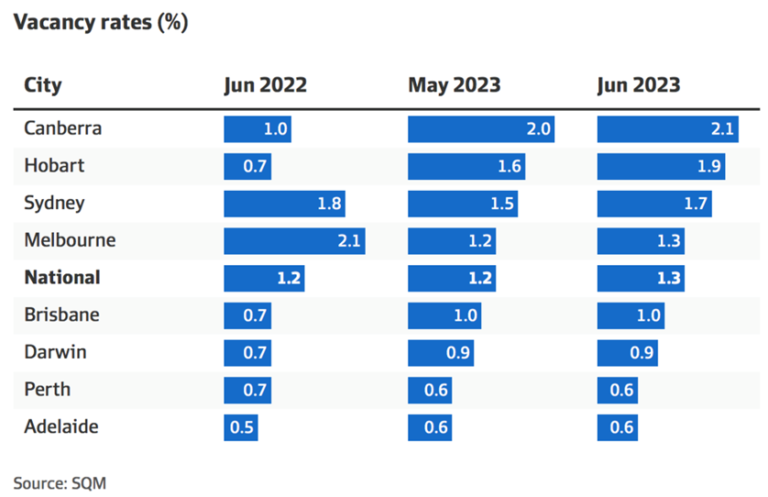

Some experts believe that the housing shortage in Australia is particularly evident in the rental market, and the decline in housing approvals implies a reduction in the number of completed residential properties over the next decade, which will prolong the housing shortage situation into the latter half of this decade.

After seasonal adjustment, the value of new building loans provided to homeowners decreased by 7% to AUD 1.6 billion, hitting a three-year low, and new residential construction by homeowners outnumbered that by investors. Prior to seasonal adjustment, in February, there were 1,501 commitments for new house construction loans to investors, down 5.8% from a year ago. The value of new building loans to investors, without seasonal adjustment, was AUD 850 million, up 4.2% year-on-year. (The figure is from NHFIC and Australian Financial Review).